Open Your Prominence Bank Account

Here’s what you receive

- Open a Personal or Business/Corporate account

- Minimum Available Balance: Personal — $/€5,000; Business/Corporate — $/€10,000. Must be maintained at all times; fees are deducted post-service and do not count toward the minimum

- 24/7 Internet banking access

- You have full control over your account

- Access our Multi-Currency Flex service for deposits and withdrawals in all major currencies

-

Receive KTT Telex transfers; send and receive SWIFT wire transfers

KTT processing requires good standing and the minimum available balance

- Your transactions are secure, and all data remains strictly confidential

- Strong international banking privacy and asset protection

Why Choose Prominence Bank?

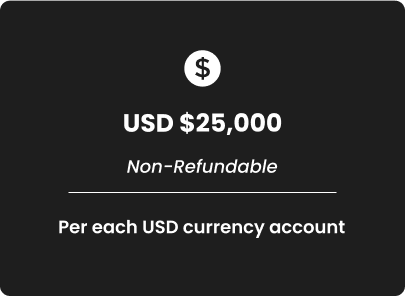

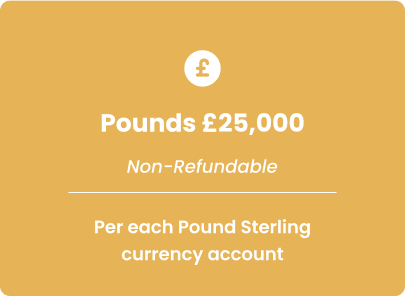

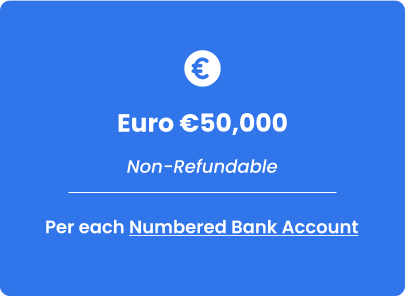

At Prominence Bank, we deliver an unparalleled banking experience for clients who value discretion, security, and privacy. The €/$25,000 account-opening fee supports enhanced compliance, private infrastructure, and premium service—ensuring your financial activity remains confidential and your transactions are executed with the highest professionalism and integrity.

Key Benefits of a Prominence Bank Account

1. Privacy & Confidentiality

Bank-grade encryption, strict access controls, and a privacy-forward jurisdiction. We never sell client data; information is shared only to operate your account or when required by law.

2. Discreet Banking

Transfers are processed with discretion through our correspondent network. Counterparty details are limited to what is operationally necessary and legally compliant.

3. Global Business Flexibility

Personal or Business/Corporate accounts, 24/7 Internet banking, multi-currency deposits/withdrawals, and cross-border settlement via SWIFT (outgoing) and KTT (incoming).

4. Premium, Compliance-Led Service

The €/$25,000 account-opening fee supports enhanced compliance, private infrastructure, and concierge onboarding—delivering fast setup and ongoing priority support.

Why the €/$25,000 Account-Opening Fee

It funds enhanced security, rigorous compliance, private infrastructure, and priority onboarding—delivering lasting value

1. Enhanced Security & Infrastructure

Dedicated private banking infrastructure, bank-grade encryption, and strict access controls protect your accounts and data.

2. Compliance & Risk Management

Comprehensive KYC/AML review, ongoing monitoring, and controlled processing under bank procedures to safeguard every transaction.

3. Privacy-Focused Banking Access

Discreet, cross-border banking supported by a specialist team and a privacy-forward framework—without compromising legality.

4. Priority Onboarding & Long-Term Value

Concierge setup (target 72 business hours after KYC/AML + fee), premium support, and continuous platform improvements.

Bank account opening fees Requirements

Estimated Completion Time

Accounts open within 72 business hours after receipt and verification of the account-opening fee

Account Opening Procedures

Complete the Personal or Business/Corporate Account Application using the links below. Submit the required KYC/AML documents; you will receive a unique Payment ID for the opening fee

After we receive and verify your payment confirmation, your account will be opened within 72 business hours and activated for online banking. You will receive your login credentials and funding instructions

Need a Bank Account?

Please do not hesitate to ask us. Please also call us or email us to make sure that you will be served with our best services.

- +44 20 8895 6493

- helpdesk@prominencebank.com