FAQ

About Prominence Bank (54)

Prominence Bank does not support transactions involving illegal activities, unverified counterparties, or any activity that violates international regulations. All transactions must comply with our compliance and regulatory standards.

Yes, Prominence Bank allows clients to manage multiple accounts, including personal and corporate accounts, under a single client profile.

Yes. You can receive funds in different currencies into your Prominence Bank account. Please note, however, that exchange and conversion fees may apply. For example, KTT transactions requiring currency conversion are subject to a 0.4% conversion fee.

While multi-currency deposits are accepted, we recommend using your account’s designated currency whenever possible to avoid additional charges and ensure a smoother, more efficient transaction process.

For any inquiries or assistance, please contact our Help Desk at helpdesk@prominencebank.com. Our team is available 24/7 to respond to your questions. Kindly submit your queries in writing, and they will be addressed promptly.

Please note that, for security reasons, Prominence Bank does not provide customer service by telephone. Using our certified email channel ensures that you receive accurate, verified responses and maintains a secure record of all communications, enabling us to continuously enhance our service quality.

We look forward to assisting you.

Thank you for your interest in visiting our head office. As a fully digital bank, Prominence Bank operates exclusively online to provide our clients with efficient, secure, and convenient banking services. We do not maintain physical branch locations for customer visits or appointments.

Our primary customer support channel is our 24/7 Help Desk email service. For any inquiries or assistance, please contact us at helpdesk@prominencebank.com, and our dedicated team will respond promptly.

Please note that our account opening process is conducted entirely online, ensuring a streamlined and expedited onboarding experience for all clients.

We appreciate your understanding and cooperation as we continue to deliver seamless digital banking services. Should you require further information or assistance, please reach out to us via our Help Desk email.

Thank you for choosing Prominence Bank.

Prominence Bank focuses on banking services rather than direct investment management. However, we can facilitate financial instruments for investment purposes or work alongside your investment advisors.

Yes, Prominence Bank specializes in international transactions and can facilitate cross-border payments, KTT wire transfers, and the issuance of financial instruments globally.

Yes, Prominence Bank provides financial instruments such as SBLCs, BGs, and documentary letters of credit (DLCs) that can be used for project funding and securing financing agreements.

No. Prominence Bank does not initiate or participate in phone calls or Zoom meetings regarding KTT (Key Tested Telex) transfers. This policy ensures the highest levels of security, prevents potential fraud, and maintains a clear, auditable communication trail.

If the sending bank requires verification or formal coordination, they must submit their request via official KTT message, bank-to-bank, in accordance with international banking standards. This is the only accepted method for initiating or confirming KTT-related procedures with Prominence Bank.

Our listed +44 telephone number connects to our international 24/7 service center, designed to support clients across all regions. While Prominence Bank operates under the sovereign jurisdiction of the Diplomatic Jurisdiction – ETMO, we maintain multiple global communication channels to ensure seamless service. All official transactions, agreements, and regulatory obligations are conducted exclusively under the authority of Prominence Bank’s Diplomatic Jurisdiction – ETMO banking charter.

1. What are cookies and why does Prominence Bank use them?

Cookies are small text files stored on your device when you visit websites. Prominence Bank uses cookies to ensure secure access, enhance user experience, and improve website performance and compliance with applicable regulations.

2. Are cookies mandatory to use the Prominence Bank website?

Strictly necessary cookies are essential for secure navigation and access to account services. You may disable non-essential cookies, but doing so may limit certain functionalities or performance features of the website.

3. What types of cookies does Prominence Bank use?

We use:

-

Strictly Necessary Cookies for secure access and functionality.

-

Performance Cookies to analyze website traffic.

-

Functionality Cookies to remember user preferences.

-

No advertising cookies are used.

4. Does Prominence Bank use third-party cookies?

Yes, but only for analytics purposes. Services like Google Analytics may place cookies to collect anonymous usage data. We do not use third-party cookies for advertising or marketing.

5. How can I control or disable cookies?

You can manage your cookie preferences through your browser settings. Most modern browsers allow you to block or delete cookies at any time.

6. Do cookies collect my personal banking data?

No. Cookies used by Prominence Bank do not store sensitive financial or account information. They are used solely for security, navigation, and performance optimization.

7. Will disabling cookies affect my online banking experience?

Yes. Disabling essential cookies may prevent you from logging in or using secure features of our online banking system. We recommend keeping strictly necessary cookies enabled.

8. How long do cookies remain on my device?

Some cookies are session-based and are deleted when you close your browser. Others may remain for a limited duration unless manually cleared through your browser settings.

9. Is my cookie data shared with anyone?

Cookie data is never sold or disclosed for marketing. Any data collected via third-party analytics tools is anonymized and used solely to improve website performance.

10. Where can I find more details?

For full information, please refer to our Cookie Policy and Privacy Policy, or contact our Data Protection Officer at helpdesk@prominencebank.com

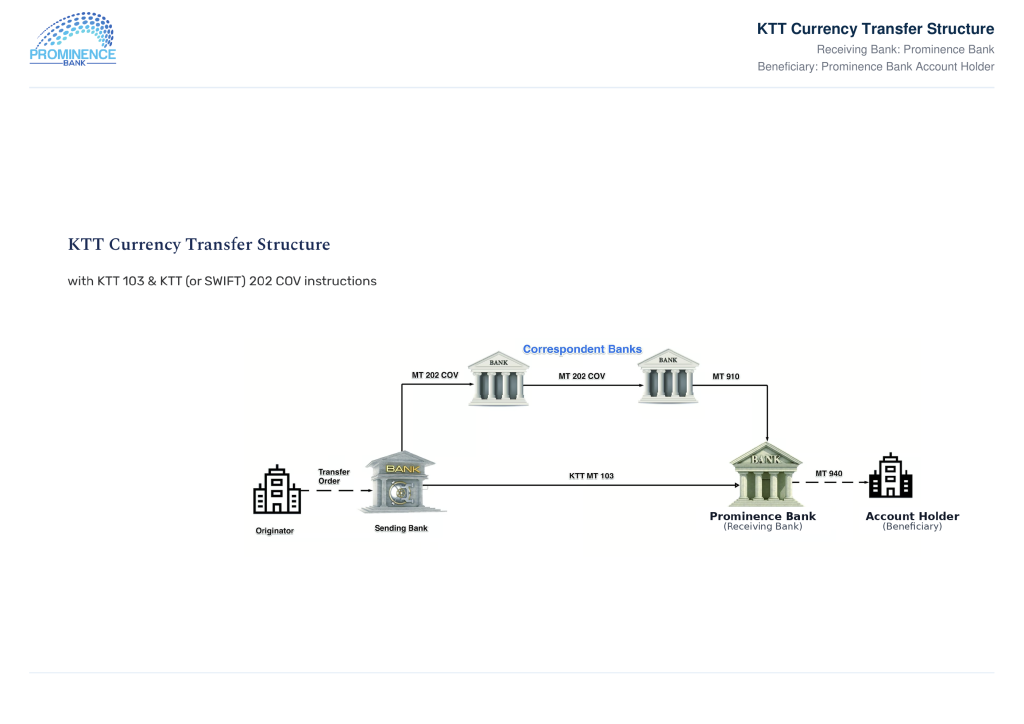

Prominence Bank accepts all types of financial transactions, including all forms of KTT (Key Tested Telex), from any financial institution worldwide. We do not restrict or block any sender bank, Telex code, jurisdiction, or transaction format. Additionally, we support and accept all procedures our clients may require for the successful execution of their transactions.

Please note that Prominence Bank does not communicate with other financial institutions to initiate a KTT transaction or any type of transaction. As we accept all transaction types and all procedures, you only need to initiate your KTT transfer by following the instructions available in your Online Banking portal, under the ‘Funds Transfer’ section.

In accordance with our banking policies, bank-to-bank or bank-officer-to-bank communication is strictly prohibited. We do not intervene in transactions or negotiations between account holders and their remitters. Furthermore, we do not conduct calls, exchange emails, or coordinate transactions with other financial institutions regarding transfers initiated outside of Prominence Bank.

You may proceed with full confidence knowing that Prominence Bank maintains an open, secure, and policy-compliant environment for all client-directed transactions.

Yes. Prominence Bank accepts all types of KTT transactions and provides comprehensive KTT services to all account holders. There is no need to be concerned whether the originating system is analog or digital.

If you wish to receive a funds transfer or communicate with another bank via the KTT system, simply provide the required information to Prominence Bank. Our dedicated department will manage the KTT request and ensure it is transmitted to the intended recipient.

Our KTT capabilities include:

-

Cash transfers

-

Bank instruments

-

Direct bank-to-bank communications

We are committed to offering our clients flexible and reliable options to meet their banking needs.

We are pleased to inform you that Prominence Bank’s services are available worldwide, with no country restrictions. This allows us to serve clients across various regions, including the USA and Europe, without limitations.

Yes. Prominence Bank offers a secure mobile banking application that allows you to conveniently manage your accounts and send funds directly from your smartphone.

With our mobile banking app, you can:

-

View and manage all your accounts in one place

-

Transfer funds between your accounts

-

Make domestic and international payments and transfers

-

Update your personal details securely

-

Track and categorize your expenses

-

Manage regular payments and standing orders

-

Send money to friends and family quickly and securely

Download the Prominence Bank mobile app today to stay in control of your finances—anytime, anywhere.

Prominence Bank does not issue debit or credit cards, including Visa or MasterCard. Account access and transactions are conducted through our secure 24/7 internet banking platform. Eligible account holders may, where supported and approved, receive incoming funds via card-network processing (e.g., VisaNet) for credit card transactions. Availability is subject to eligibility, corridor support, compliance screening, and final bank approval.

Yes, Prominence Bank provides escrow services to our account holders only, to ensure secure and transparent transactions between parties. These services are tailored for high-value transactions where financial trust is critical.

Yes. Prominence Bank will refund any fees related to failed or undelivered services. All refund requests are reviewed by the compliance department, and refunds are issued promptly when justified.

No, Prominence Bank does not offer the ability to buy or sell cryptocurrencies. We only facilitate the conversion of cryptocurrencies into fiat currencies once they have been deposited into your account.

Yes, Prominence Bank offers account management tools that allow clients to monitor transactions, access statements, and manage their accounts securely online.

Yes, Prominence Bank specializes in issuing Standby Letters of Credit (SBLCs) and Bank Guarantees (BGs). These financial instruments are used to facilitate international trade, secure transactions, and provide financial assurance to counterparties.

Clients can access their accounts via the online banking platform or mobile app, which provides 24/7 secure banking services.

How to Open a Bank Account with Prominence Bank

-

Complete the Online Application Form:

Choose the appropriate application type:

-

Pay the Account Opening Fee:

Submit the non-refundable €25,000 account opening fee via SWIFT wire transfer or cryptocurrency (USDT). Please note: KTT transfers cannot be used to pay this fee.

-

Alternative – Downloadable Application:

If you encounter any difficulties with the online form, you may download the application:

-

Submit Your Application:

Send the completed application along with proof of payment to helpdesk@prominencebank.com.

How to Open a KTT Bank Account with Prominence Bank

-

Select the Appropriate Application Form:

-

Complete the Application:

Fill out the selected Personal or Business Bank Account Application accurately and in full.

-

Pay the Account Opening Fee:

Submit the non-refundable €25,000 account opening fee via SWIFT wire transfer or cryptocurrency (USDT). Please note: KTT transfers cannot be used to pay this fee.

-

Enable KTT Transfers:

Once your account is opened, you may request KTT transfer capability. Activation typically takes 24 hours and is provided at no additional cost.

-

Begin Transactions:

Your account will be ready for transactions within 72 business hours after payment confirmation.

To open an account, submit an online application form and pay the required account opening fee of €25,000 via SWIFT transfer or cryptocurrency (USDT). Accounts typically activate within 72 business hours after payment verification. A minimum balance must be maintained as outlined in your account terms.

Prominence Bank operates under Foreign Jurisdiction License No. 05052025-A (Diplomatic Jurisdiction – ETMO). For official verification, use your PIN on our site or email verify@prominencebank.com. We do not publish sensitive licensing documents publicly; please rely on our official channels for confirmation.

Locating Your Wire Transfer Instructions

Within your online banking portal, there is a dedicated section containing the information required to receive wire transfers, including KTT (Telex) transfers. This section typically includes:

-

Bank Name:

-

Bank Address:

-

Account Number: (Insert your bank account number)

-

Account Name: (Insert the account holder name)

-

KTT Telex Code:

-

Bank Officer:

-

Bank Officer PIN Code:

-

Bank Email:

-

Bank Telephone:

Please ensure you provide the complete and accurate details from this section to the sender or remitter to avoid delays in processing your incoming funds.

Submit an online application form and pay the required €25,000 account opening fee via SWIFT or cryptocurrency (USDT). Accounts typically activate within 72 business hours. A minimum balance as outlined in your account terms must be maintained.

Prominence Bank adheres to strict international banking regulations, including AML, KYC, and counter-terrorism financing standards. All transactions and accounts are subject to thorough compliance checks to ensure legal and regulatory adherence.

No. Prominence Bank does not offer joint account services. Each account is registered to a single holder.

Yes, Key Tested Telex (KTT) is automatically enabled upon account activation at no extra cost. Prominence Bank credits KTT transactions received from sending banks without pre-verifying transaction details. Clients must ensure sufficient balance to cover associated fees.

No. Prominence Bank is not soliciting to provide a service. You contacted the Bank, and we will consider providing services only if you proceed in full accordance with our published procedures and institutional policies.

Yes. Prominence Bank remains fully operational and is licensed under Foreign Jurisdiction License No. 05052025-A, issued by the Diplomatic Jurisdiction – ETMO. Claims of liquidation or shutdown are untrue. For official updates, always consult our website or contact us directly.

1. What type of personal data does Prominence Bank collect?

We collect only the data necessary to provide secure and compliant banking services. This includes your identification details, contact information, financial and transactional data, as well as communications with our institution.

2. Why does Prominence Bank collect my personal information?

We collect your information to open and manage accounts, process transactions, meet regulatory obligations, enhance our services, and maintain secure communications with you.

3. Does Prominence Bank share my personal data with third parties?

We do not sell or disclose your data to third parties for marketing purposes. We only share data with regulatory authorities, legal entities, and authorized service providers, and only under strict confidentiality agreements and legal requirements.

4. How does Prominence Bank protect my data?

Your data is protected through industry-standard encryption, strict access controls, regular monitoring, and secure infrastructure. We adhere to international data security protocols to maintain confidentiality and integrity.

5. Where is my data stored and processed?

Data may be processed in our primary jurisdiction and other international jurisdictions as required for service delivery. All transfers are handled with strong data protection safeguards in accordance with applicable legal frameworks.

6. Can I access or update my personal data?

Yes. You have the right to access, update, or correct your personal data. Please submit a formal request to our compliance team via email at helpdesk@prominencebank.com.

7. How long does Prominence Bank retain my data?

We retain personal data only for as long as necessary to fulfill contractual, regulatory, and operational obligations. Retention periods may vary depending on applicable laws and banking compliance requirements.

8. Can I request that my data be deleted?

In certain circumstances, you may request deletion of your data. However, due to legal, regulatory, and financial compliance obligations, certain records must be retained as mandated by law.

9. Does the Privacy Policy apply to website visitors as well as clients?

Yes. This policy applies to all individuals who interact with our website and services, whether or not they maintain a formal banking relationship with Prominence Bank.

10. Is Prominence Bank compliant with international data protection laws?

Yes. Prominence Bank adheres to globally recognized data privacy standards and frameworks, including the principles of confidentiality, necessity, proportionality, and consent-based processing.

11. How will I know if the Privacy Policy has changed?

We post all updates on our website with a revised “Last Updated” date. We encourage you to review the Privacy Policy periodically to remain informed of how your data is protected.

12. Who do I contact for privacy-related inquiries?

For any questions or concerns regarding your personal data, please contact:

Data Protection Officer

Prominence Bank

Email: helpdesk@prominencebank.com

Phone: +44 20 8895 6493

Address:

Prominence Bank

Foreign Jurisdiction License No. 05052025-A

ETMO Diplomatic Jurisdiction

Prominence Bank offers expertise in handling high-value and complex transactions, ensuring speed, security, and reliability. Clients benefit from dedicated support, tailored solutions, and access to international banking networks.

Prominence Bank supports transactions in multiple currencies, allowing clients to conduct business globally. Please contact us for a complete list of supported currencies.

For opening a personal account, only a passport is required. To open a business account, both a passport and company incorporation documents are necessary.

Prominence Bank charges standard fees such as the €25,000 account opening fee, monthly maintenance fees, and transaction fees (e.g., 1.5% for KTT). Fees for failed or undelivered services are refundable upon review by the compliance department.

Prominence Bank applies standard fees, including account opening fees (€25,000), monthly maintenance fees, and transaction fees (e.g., 1.5% for KTT transfers). A full, transparent fee schedule is available on our official website.

Prominence Bank serves a variety of industries, including trade and commerce, real estate, energy, manufacturing, and finance. Our services are tailored to meet the needs of corporations, entrepreneurs, and institutional clients.

Prominence Bank – Cryptocurrency Accounts

Cryptocurrency is a digital form of currency that uses cryptography to secure transactions and create new coins. It can be viewed as a digital equivalent of traditional currencies such as the US Dollar or the Euro. Bitcoin, introduced in 2009, was the first cryptocurrency, and since then, hundreds of alternative cryptocurrencies—commonly known as “altcoins”—have emerged.

Prominence Bank offers cryptocurrency accounts designed to help you manage and safeguard your digital assets with ease, security, and privacy.

Account Features:

-

Cryptocurrency Wallet: Fund your wallet and transfer between your cryptocurrency account and your regular bank account.

-

Secure Transactions: All transfers are conducted securely and confidentially.

-

Multi-Currency Support: Move funds between your cryptocurrency and Prominence Bank accounts in USD, GBP, EUR, and more.

-

User-Friendly: Simple and efficient account opening and management process.

Benefits of a Prominence Bank Cryptocurrency Account:

-

Tax Haven Banking Secrecy: Maximum privacy and security in a protected jurisdiction.

-

Full Control: You retain complete control over your account.

-

No References Required: No need for bank references or personal visits.

-

Low Maintenance Costs: Minimal fees and no monthly maintenance charges.

-

Swift Transactions: Instant capability to send and receive SWIFT wire transfers.

Opening Fees and Requirements:

-

Opening Fee: €25,000 per cryptocurrency account

-

Minimum Balance: Equivalent of USD 100 in cryptocurrency

-

Monthly Charge: None

-

Processing Time: 7 banking days from receipt of opening fee

Account Opening Procedure:

-

Complete the application form accurately.

-

Email the completed form to account@prominencebank.com.

-

Send the opening fee deposit.

-

Your account will be activated within 7 banking days.

Prominence Bank is a fully digital international bank operating exclusively online. It is licensed under the sovereign jurisdiction of the Diplomatic Jurisdiction – ETMO and provides secure, private banking services to corporations, entrepreneurs, and high-net-worth individuals around the world.

Prominence Bank credits incoming KTT transactions directly to your account once received from the sender’s bank. The bank does not pre-verify amounts or details and will only credit transactions fully compliant with internal compliance procedures, including fee availability.

Prominence Bank operates under a Class ‘A’ Banking License (License No. 05052025-A), issued by the Diplomatic Jurisdiction – ETMO. This license authorizes Prominence Bank to provide a full spectrum of international banking services under the sovereign authority of the Theocracy Government.

Issuing an SBLC involves submitting an application along with the necessary documentation, including details of the transaction, parties involved, and the collateral offered. Once approved, the SBLC is issued to the designated beneficiary through secure banking channels.

We utilize our correspondence bank’s SWIFT code for transfers, which may vary depending on the currency of the transaction (USD or Euros). Please note that this information is accessible exclusively to our account holders and can be found within the internet banking platform under the “Funds Transfer” section.

Prominence Bank offers personal and corporate banking, cryptocurrency accounts, escrow services, structured finance, and issuance of financial instruments such as SBLCs and Bank Guarantees (BGs).

Prominence Bank provides Personal and Business bank accounts, as well as specialized accounts like Cryptocurrency Accounts and Custodial Accounts for financial instruments.

Prominence Bank is a fully licensed digital international bank, operating under ETMO’s sovereign jurisdiction with License No. 05052025-A. We comply with international AML/KYC and banking regulations to provide secure, confidential services—without physical branches.

Both individuals and corporate entities can open accounts with Prominence Bank. However, all applicants must meet compliance requirements, including KYC verification.

Why Choose Prominence Bank for Your Banking Needs?

At Prominence Bank, we offer a unique and unparalleled banking experience designed for clients who prioritize discretion, security, and privacy. Our €25,000 account opening fee reflects the extraordinary measures we take to provide these benefits, ensuring that your financial activities remain confidential and your business transactions are conducted with the utmost professionalism and integrity.

Key Benefits of Opening an Account with Prominence Bank

1.Total Privacy and Confidentiality

Prominence Bank operates under a robust trust structure, performing 100% of all transactions on behalf of our clients. This ensures that your personal or business information is never disclosed to any third party. All incoming and outgoing transfers, as well as other banking operations, are handled by the bank itself, making the account holder completely invisible in all transactions.

2.Incognito Transactions

Every transaction performed under Prominence Bank is conducted with anonymity. Whether you’re making transfers, receiving payments, or managing your assets, your identity and information are fully protected. This unique feature provides peace of mind to our clients, knowing their financial activities are shielded from prying eyes.

3.Global Business Flexibility

Our specialized banking services cater to high-net-worth individuals, global entrepreneurs, and businesses operating across multiple jurisdictions. With Prominence Bank, you gain access to seamless and discreet banking solutions that support your international ventures without compromising your privacy.

4.Exclusive Services for Discerning Clients

The cost of maintaining such a high standard of security and privacy is significant. The €25,000 account opening fee ensures that we can provide you with cutting-edge infrastructure, legal compliance, and operational excellence, delivering a banking experience that exceeds industry standards.

Different banks offer varying services and fee structures. While some may not charge upfront fees, they may offset this with higher transaction costs or minimum balance requirements. At Prominence Bank, our transparent fee structure enables us to deliver the specialized, secure, and confidential banking services our clients rely on.

Benefits of Banking with Prominence Bank:

-

Unmatched Confidentiality: All transactions are processed through trust accounts, ensuring the highest level of privacy and discretion.

-

Global Reach: Our extensive network of international correspondent banks facilitates seamless worldwide transfers.

-

Robust Security: We deploy advanced security technologies to safeguard your assets at every stage.

-

Dedicated Support: Our team is committed to providing exceptional service and personalized client care.

Why Does It Cost €25,000 to Open an Account?

The €25,000 is not simply an account opening fee—it is an investment in unparalleled privacy, security, and peace of mind.

1. Enhanced Security Measures

Operating fully private accounts requires specialized infrastructure, advanced security protocols, and strict adherence to international banking regulations. These measures ensure your account remains secure from breaches, unauthorized access, and cyber threats.

2. Trust-Based Transactions

All transactions are executed under the bank’s name, safeguarding your identity and ensuring complete discretion. This level of confidentiality requires dedicated operational resources and a highly trained team to manage accounts with precision and security.

3. Exclusive Access to Privacy-Focused Banking

Prominence Bank caters exclusively to clients who value confidentiality in today’s interconnected world. Maintaining this exclusivity demands ongoing investment in cutting-edge technology and expert personnel.

4. Long-Term Value

The fee grants access to an elite banking network, offering benefits that far exceed the initial investment. From discreet account management to tailored financial strategies, Prominence Bank delivers exceptional value for high-profile and global clients.

Invest in Privacy and Security with Prominence Bank

Opening an account with Prominence Bank means partnering with a trusted institution committed to safeguarding your assets and identity. The €25,000 ensures you receive best-in-class banking services designed for discerning clients who demand the highest standards of confidentiality and excellence.

Account Access & Management Policies (18)

No. Sharing login credentials is strictly forbidden and constitutes a violation of our security terms.

No. Prominence Bank accounts are individually held and do not permit joint access, signatories, or third-party delegation (including lawyers, accountants, or family members). Each account is accessible only by the registered account holder.

No third parties (whether additional users, joint owners, beneficiaries, attorneys-in-fact, etc.) are allowed access – each account is limited to the single registered holder.

Yes, you can access your account online! Our online banking platform allows you to manage your account conveniently from anywhere with an internet connection.

No. Transaction authority is limited exclusively to the verified account holder.

No. As per Prominence Bank’s Terms and Conditions, which every client accepts automatically by signing and submitting the account application form, accounts cannot be closed once they are activated. The Terms and Conditions are fully visible inside the application form prior to submission and are legally binding. This policy exists due to the significant costs and resources invested in onboarding, compliance, risk management, and maintaining international banking infrastructure.

No. Accounts cannot be closed by clients; closure is exclusively managed by Prominence Bank’s compliance and administrative departments. Additionally, Prominence Bank does not permit joint accounts or third-party access, ensuring maximum account security and confidentiality.

No. While estate instructions may be reviewed upon official notice, no beneficiary or successor can be registered on an active account.

No. Account access is limited exclusively to the named account holder, in accordance with our compliance policy.

Unfortunately, you cannot access a personal or business account prior to transferring funds and paying the account opening fee. These steps are essential to activate your account.nn

No. Corporate accounts are limited to a single authorized signatory as registered with the bank.

If you experience an issue, you can contact our customer service team to file a formal complaint. Prominence Bank is committed to resolving client concerns promptly and professionally.

To update your account information, contact our customer service team or your relationship manager. Supporting documentation may be required for certain updates, such as changes to address or ownership details.

No. Prominence Bank does not accept powers of attorney for account operation or management.

1. Introduction

Prominence Bank is committed to providing secure and efficient Key Tested Telex (KTT) services to facilitate international financial transactions. This policy outlines the terms, conditions, and procedures governing KTT transactions to ensure compliance, security, and customer satisfaction.

2. Eligibility

The Key Tested Telex Transfer (KTT) service is automatically enabled upon account opening. No additional request or activation is required.

3. Transaction Limits

-

Minimum tranche size: €10 million per transaction

-

Maximum tranche size: €500 million per transaction

-

Frequency: No restrictions on the number of daily tranches

-

Note: These limits are non-negotiable and cannot be modified.

4. Fees and Charges

-

Incoming KTT transactions: 1.5% fee applies

-

Outgoing wire transfers: 1% fee plus SWIFT/SEPA costs

-

Note: Prominence Bank does not impose upfront fees; charges apply only after the requested service is completed.

5. Transaction Types

Prominence Bank supports:

-

Cash transfers

-

Bank instruments

-

Direct bank-to-bank communications

This flexibility allows us to accommodate a wide range of client requirements.

6. Client Responsibilities

If you have provided KTT instructions to your remitter, it is your responsibility to fully understand and manage the nature of the transactions being sent to your account. Prominence Bank:

-

Is not involved in agreements, terms, or instructions exchanged between you and your remitter.

-

Will not process or review pending KTT transactions if your account is in delinquent status or not in good standing.

7. KTT Transaction Policy

Prominence Bank will credit your account with whatever is received as per the remitter’s bank instructions. However:

-

No guarantees: We do not guarantee the nature or outcome of any transaction initiated by another bank or remitter.

-

Non-involvement: We do not participate in, or provide guarantees for, transactions you or your remitter initiate.

-

Responsibility: Only you and your remitter can confirm transaction details before they are processed.

8. Security and Compliance

-

Verification: Clients are advised to conduct due diligence and, where necessary, consult with our team before initiating KTT transactions.

-

Compliance: All transactions must comply with Prominence Bank’s compliance and regulatory requirements.

9. Confidentiality

All incoming and outgoing transactions are processed through Prominence Bank’s trust accounts, ensuring maximum discretion and the protection of account holder information.

10. Amendments

Prominence Bank reserves the right to amend this policy to comply with regulatory changes or enhance service quality. Clients will be notified promptly of any significant updates.

11. Contact Information

For assistance or inquiries regarding KTT transactions, please contact our Help Desk at helpdesk@prominencebank.com. Our team is available 24/7.

Clients can reset their password through the secure online banking portal. In case of further issues, they can contact customer support via email.

If you wish to stop receiving KTT transactions, you may request to block KTT on your account. Any subsequent KTT transactions received on your behalf will be ignored.

Your account has been blocked from receiving further KTT transactions due to its current delinquent status. Please note that Prominence Bank does not process KTT transactions for accounts in delinquent status.

To lift the block, your account must be brought out of delinquency and adequately funded. It is your responsibility to ensure your account maintains sufficient funds if you wish to process KTT transactions.

Account Closure and Banking Relationship Policy (ETMO Framework) (3)

Can I close my account at any time?

No. Client-initiated account closure is not permitted. All account closures are administered exclusively by Prominence Bank’s internal Administration and Compliance departments and may only be executed following internal review (including risk, AML/KYC, and security controls) and in accordance with the Bank’s contractual framework.

Prominence Bank operates under the sovereign diplomatic framework of the Ecclesiastical and Temporal Missionary Order (ETMO). The client relationship is governed by the Bank’s Terms & Conditions accepted at onboarding, together with internal compliance and risk policies applicable to accounts maintained under this framework. For transparency, these terms are also published in our public FAQ.

By opening an account with Prominence Bank, the applicant expressly acknowledges and accepts that:

Unilateral account termination by the client is waived under the contractual relationship established with the Bank; and

Account closure is not a customer service option on demand, but a controlled compliance process administered solely by the Bank.

Accordingly, a client may not “close the account” by request, even if the client chooses to stop using the services.

Why does Prominence Bank apply this policy?

This policy exists to protect:

Regulatory and compliance integrity (including AML/KYC obligations, sanctions controls, fraud prevention, and ongoing risk monitoring); and

The client’s onboarding investment and account establishment costs, as onboarding and activation involve substantial administrative, compliance, and verification work and related fees. The Bank does not cancel accounts on request in a manner that would undermine onboarding integrity or create avoidable client loss through forfeited establishment costs.

If I cannot close the account, what options do I have?

If you no longer wish to use the account, you may:

Stop using the account (subject to maintaining the required minimum balance and any applicable account conditions); and/or

Instruct an outbound transfer to a bank account of your choice, provided that:

the instruction passes standard verification and compliance checks; and

the account continues to meet Prominence Bank’s minimum balance requirements at all times (including after the transfer).

An outbound transfer instruction does not constitute account closure and will not be processed as a closure request.

Under what circumstances can the Bank close an account?

Prominence Bank may close or terminate an account only where permitted by internal policy and after internal review, including (without limitation):

confirmed compliance concerns or unresolved due diligence requirements;

security risk, fraud risk, misuse, or legal/regulatory exposure;

breach of contractual terms; or

accounts maintaining a zero or negative balance with no activity for 90 consecutive days, which may be reviewed and closed in line with AML/compliance standards.

Important clarification

Prominence Bank does not close accounts merely because a client requests closure. The account remains governed by the Bank’s internal administration and compliance process. Where a client wishes to disengage, the correct approach is to transfer funds out (subject to minimum balance rules and compliance checks) and then maintain the account in accordance with the applicable conditions.

No. Prominence Bank does not permit clients to initiate account closure at their discretion.

Account closure is managed exclusively by Prominence Bank’s internal Administration and Compliance departments and may only occur following internal review (including risk, AML/KYC, security controls) and in accordance with the Account Terms & Conditions accepted at onboarding and published in our FAQ.

Accounts maintaining a zero or negative balance with no activity for 90 consecutive days may be reviewed and closed by the Bank in line with compliance standards.

No. Accounts cannot be closed by clients; closure is exclusively managed by Prominence Bank’s compliance and administrative departments. Additionally, Prominence Bank does not permit joint accounts or third-party access, ensuring maximum account security and confidentiality.

Account Opening & Onboarding (17)

Yes. Withdrawals are only permitted when the account balance remains above the required minimum thresholds: €5,000 for personal accounts and €10,000 for business accounts. Our system is technically restricted from processing any withdrawal that would cause the balance to fall below these minimums. This ensures that the account remains active and compliant with the Bank’s operational policies.

All accounts are opened directly with Prominence Bank under the sovereign jurisdiction of the Diplomatic Jurisdiction – ETMO. This structure ensures full compliance with our internal regulations and the regulatory framework established by the Diplomatic Jurisdiction of a Theocracy Government.

No. The non-refundable €25,000 account opening fee is mandatory and covers enhanced privacy, security infrastructure, and international services. It cannot be waived or deducted from future transfers.

Client communications are governed by our client service framework. After successful onboarding and verification, eligible account holders may communicate with the Bank through official channels in accordance with that framework.

No. The opening fee must be prepaid via SWIFT or USDT, and cannot be paid via KTT or deducted from future transfers.

No. The minimum balance required in your account is non-transferable and non-withdrawable under any circumstances. This mandatory balance must be maintained at all times and serves as a compliance requirement to keep the account in good standing.

Clients may only withdraw or transfer funds above the minimum balance. The minimum balance itself is not accessible and cannot be used for transactions, payments, or deductions.

Please note that your account will not be activated or enabled until the full minimum balance is deposited and maintained.

- Choose either our Personal or Business account application online.

- Submit the completed application to account@prominencebank.com with proof of payment (SWIFT or USDT).

- Once the €25,000 opening fee is confirmed, your account will be activated within 72 business hours. KTT capability is automatically enabled upon activation.

- Complete the Personal or Business application online.

- Pay the €25,000 non-refundable opening fee via SWIFT or USDT (KTT cannot be used).

- After payment confirmation, your account is activated within 72 business hours.

- KTT transfers can be enabled upon request at no additional cost (typically within 24 hours). A minimum balance must be maintained as set out in your account terms.

Submit your account application via our website and follow the published onboarding steps. After successful onboarding and verification, eligible account holders may access services in accordance with our client service framework.

No. Prominence Client Management / Prominence Account Management provides administrative onboarding coordination only and cannot approve accounts or provide banking or advisory services.

No. It is a service fee for onboarding/compliance processing support and does not create/fund an account.

No. The EUR 25,000 is not a minimum balance.

- It is a non-refundable custody service fee (“cost to the account”).

- It does not represent funds available for your use and does not count as liquid balance.

If our procedures are not acceptable to you, you are free to seek another financial institution that aligns with your preferred process. Prominence Bank does not alter its policies for individual applicants.

Prominence Bank charges a mandatory, non-refundable €25,000 account opening fee for all new accounts. This fee cannot be waived under any circumstances. It covers the costs of the Bank’s enhanced security systems, privacy protections, compliance infrastructure, and specialized banking services designed for high-net-worth clients. These measures ensure a secure, private, and exclusive banking environment that differentiates Prominence Bank from conventional financial institutions. Unlike many banks, Prominence Bank’s model prioritizes bespoke, high-standard service and robust infrastructure, which this one-time opening fee directly supports.

The custody account carries a non-refundable fee of EUR 25,000.

- This is a service fee for establishing and maintaining the custody structure.

- It is not a deposit, is not credited to your balance, and is not refundable under any circumstance, regardless of future use or inactivity of the account.

Your Application ID exactly as shown in the form/payment instructions.

Provide clear, specific questions and basic context (e.g., applicant name/company name and the service requested). Do not send sensitive information unless requested through the official onboarding process.

Account Types, Privacy Features & Banking Services (18)

Because Prominence Bank operates under a foreign diplomatic jurisdiction (ETMO), it is not covered by traditional national deposit insurance programs like FDIC (USA) or FSCS (UK). Instead, the safety of your funds comes from the bank’s strong capitalization and strict risk management. Prominence Bank has authorized capital exceeding €5 billion and maintains high reserve ratios to protect depositors. We also employ rigorous compliance and security measures to safeguard client assets. While there isn’t a government insurance backing deposits, the bank’s solvency and commitment to confidentiality and security provide a robust safeguard. Clients seeking additional peace of mind sometimes use private deposit insurance or diversification, but Prominence Bank itself is financially structured to weather risks (and of course, we do not engage in high-risk lending, which further protects deposits). Always consider your own comfort level, but know that protecting client funds is our foremost priority.

Yes – Prominence Bank operates under a sovereign diplomatic jurisdiction (ETMO) and is fully licensed (Foreign Jurisdiction License No. 05052025-A) . Privacy-focused accounts like numbered accounts are compliant within this legal framework. While your identity is shielded from the general public or counterparties, the bank still knows who you are and complies with all necessary KYC/AML regulations behind the scenes. In any international transfer, basic required information is included (via the bank’s trust structure) to satisfy global banking rules, even though your personal details aren’t exposed to recipients. In summary, our privacy services are structured to maintain compliance with law while giving you enhanced confidentiality.

Prominence Bank welcomes international clients from all over the world. We do comply with all international sanctions and regulations, so we cannot open accounts for individuals or entities in sanctioned jurisdictions or those involved in illicit activities . For example, if a country or person is on a UN or OFAC sanctions list, we must decline. Apart from sanctioned cases, our focus is on serving high-net-worth individuals, businesses, and institutions that can meet our account opening requirements (including the €25k fee and due diligence). We do not discriminate by nationality – we have clients across Europe, Asia, the Americas, Africa, etc. – as long as they pass our compliance checks. In summary, unless prohibited by law, we’re open to clients globally, but every applicant must go through our KYC/AML review for approval.

Yes. Prominence Bank’s platform allows clients to manage multiple accounts under a single client profile . For example, you could have a personal account and one or more business/corporate accounts and switch between them online. This unified access makes it convenient to oversee all your accounts in one place (while still keeping the funds and records of each account separate).

No.

- The custody account is not a transactional account.

- Third-party transfers, payments, or day-to-day banking operations must be carried out through your operational bank account.

Prominence Bank’s niche is in offshore private banking and specialized financial services rather than traditional retail lending. We do not provide personal loans, home mortgages, or consumer credit lines. However, we do offer certain credit-related services in a specialized context – for instance, Lombard loans or credit lines secured by deposits/investments might be arranged for Private Banking clients, and we facilitate financing for trade transactions or projects via instruments and structured finance. Generally speaking, if you need a generic loan, we might not be the right fit, but if you have collateral or require structured financing, our team can often craft a solution. All lending or financing is considered on a case-by-case basis through our corporate finance or structured finance departments rather than off-the-shelf loan products.

Not at this time. Prominence Bank does not currently issue debit or credit cards linked to accounts, and we do not operate an ATM network. However, Prominence Bank account holders may be eligible to receive funds via card-network transactions (VisaNet) where supported and approved—primarily for clients who need to process incoming credit card payments. Card-network processing availability is subject to eligibility, corridor support, transaction screening, and final bank approval. Clients typically access funds for local spending by transferring from their Prominence Bank account to an external bank account for day-to-day card usage.

No. The custody account, as a “cost to the account” / asset-holding account, does not require any minimum balance.

It is not designed to hold freely available cash or to satisfy minimum balance conditions.t have a minimum balance requirement?

It is a technical account used to hold and register assets.

All deposits and withdrawals are handled via electronic transfers. To deposit, you would typically send a SWIFT wire from another bank into your Prominence Bank account (we provide you the SWIFT/account details for incoming wires). We accept inbound transfers in multiple currencies and even via KTT for large transactions. To withdraw, you initiate an outgoing wire transfer from your Prominence online banking to the external account of your choice (or request a bank draft/cashier’s check if needed for a specific purpose). Because we operate without physical branches, cash deposits or in-person withdrawals aren’t applicable – instead, everything moves through the global banking network electronically. Rest assured, even without branches, you have full access to your money: wires are processed swiftly and you can transfer to any of your local bank accounts worldwide at any time.

When you send a wire from a numbered account, Prominence Bank uses an intermediary client trust account to execute the transfer. This means on the recipient’s end, the payment will show as coming from a Prominence Bank client trust (with a reference number), rather than your personal name . This arrangement complies with international wire requirements (the bank’s name and an account reference are included for transparency), while still keeping your identity confidential to outside parties. Internally, the bank of course logs that you were the initiator of the transfer, but externally your privacy is preserved. The process for you as a user is the same as a normal transfer – you initiate the wire in online banking – and there is no extra hassle, just added anonymity.

Your custody account and your operational bank account are separate:

- The custody account:

- Holds or reflects assets.

- Carries a non-refundable EUR 25,000 custody fee.

- Has no minimum balance requirement because it is not for liquid funds.

- Your operational/current account:

- Holds liquid funds and is used for incoming/outgoing payments.

- Is the account that may be subject to minimum balance requirements, where applicable.

- Is the source from which fees and charges are actually settled.

All account types require a one-time €25,000 opening fee (except numbered accounts, which have a €50,000 opening fee due to the extra privacy services) . The minimum ongoing balance is $/€5,000 for personal accountsand $/€10,000 for business or corporate accounts (this amount must be kept in the account at all times). Cryptocurrency accounts have a small minimum equivalent (about $100 in crypto) after opening . There may also be monthly maintenance fees for accounts (as outlined in our fee schedule), but there are no monthly fees for numbered accounts specifically beyond the upfront cost. All fees are transparent – Prominence Bank publishes a full schedule on its website and any special account fees (like the numbered account fee) will be clearly communicated before you apply.

A custody account is an account designated to hold and safeguard assets, not to hold liquid funds for day-to-day banking.

- It is used to register and protect financial instruments, assets, or positions.

- It is not a current account, savings account, or payment account and is not used for regular transfers or payments.

A Numbered Bank Account is a special type of account that provides an extra layer of confidentiality. Instead of your name, the account is primarily identified by a multi-digit number known only to you and a few senior bank officers . When you perform transactions from a numbered account, the account number (or an internal trust account name) appears as the sender, rather than your personal name . This offers enhanced privacy, protecting your identity in external transfers. Key benefits include: non-traceable outbound transfers, very strong banking secrecy (useful in tax planning within legal bounds), and protection of assets from prying eyes – for instance, your assets in a numbered account are shielded from public view, which can be advantageous in situations like high-profile transactions or contentious legal matters (e.g. divorces or lawsuits) . Numbered accounts are fully legal and compliant; they simply add confidentiality by using the bank’s omnibus structures for outward payments.

The custody account carries a non-refundable fee of EUR 25,000. This is a service fee (“cost to the account”), not a minimum balance and not available for your use. The custody account is designated to hold assets, not liquid funds, and therefore does not have any minimum balance requirement. Any minimum balance obligations apply only to your normal operational/current account, not to the custody account.

The custody account carries a non-refundable fee of EUR 25,000.

- This is a service fee for establishing and maintaining the custody structure.

- It is not a deposit, is not credited to your balance, and is not refundable under any circumstance, regardless of future use or inactivity of the account.

Business Banking accounts are tailored for small-to-medium enterprises and entrepreneurs, providing everyday multi-currency banking, 24/7 online access, and standard SWIFT wire capabilities . Corporate Banking accounts are designed for larger companies or complex organizations – they support more sophisticated needs like consolidated account structures, multiple user logins with role-based approvals, and dedicated onboarding support for international operations . In short, business accounts cover basic company needs, while corporate accounts handle advanced requirements for large or multinational firms.

Any Prominence Bank client in good standing can request to open a numbered account (the bank does reserve the right to vet or refuse applicants, but there’s no special “invite-only” restriction) . The requirements are similar to a regular account in terms of KYC documents – for an individual, a notarized passport is needed; for a company, incorporation documents and passports for the signatory are required . Notably, no bank references are needed to open a numbered account , and no personal visit is necessary (the process can be completed 100% online, as with our standard accounts). Keep in mind that a €50,000 account opening fee applies to numbered accounts , and you must maintain at least the standard minimum balance. Once opened, your numbered account is operated through our internet banking just like any other account – with 24/7 access and full functionality

Banking Services and Products (17)

No, there are no limits on wire transfers for SWIFT, SEPA, and cryptocurrency transactions. You can send and receive funds without restrictions on the amounts, allowing for flexibility in managing your larger financial transactions.

nHowever, for KTT (Telex) wire transfers, there are specific limits in place:

– Minimum Tranche Size: 10 million

– Maximum Tranche Size: 500 million per tranchen

nAdditionally, there are no restrictions on the number of tranches you can initiate on a daily basis. Please note that these face value minimum and maximum tranches are non-negotiable and cannot be modified.

Prominence Bank – Loan Application with Safe Keeping Receipt (SKR)

Yes, you may apply for a loan using a Safe Keeping Receipt (SKR) issued by Prominence Bank. An SKR serves as valuable collateral, enhancing the likelihood of securing financing.

Key Considerations:

-

Separate Services: Asset custody and loan provision are distinct services. Custody of your assets must be established before the loan application process can proceed.

-

Performance Bond Insurance Policy: We strongly recommend obtaining a performance bond insurance policy, as it substantially improves loan approval prospects. When combined with your SKR and “Full Bank Responsibility,” this collateral is widely recognized by financial institutions.

-

Loan Approval: The presence of an SKR is an important factor; however, final approval is determined by Prominence Bank’s Credit Department. The SKR agreement does not in itself guarantee loan approval.

Loan Procedure:

-

Open a Custodian Account: This account will hold your pledged assets.

-

Deposit Assets: Assets must be deposited with the bank.

-

Asset Evaluation: An approved bank appraiser will assess the market value of your assets.

-

Loan-to-Value (LTV) Ratio: Based on asset valuation, loan amounts typically range between 20% and 65% of appraised value.

-

Performance Bond Insurance Policy: Following asset evaluation and pre-approval, a performance bond insurance policy will be required.

-

Loan Disbursement: Once all conditions are met, loan funds will be disbursed within 72 business hours.

Important Notes:

-

Asset Valuation Impact: Higher asset valuations improve loan approval chances and allow for more favorable terms.

-

Client Responsibility for Costs: All expenses related to custody, insurance, appraisal, and related services are the responsibility of the applicant.

Cost Structure:

-

Custodian Account: €25,000 upon application, plus 2% of the SKR face value (payable within six months or at loan disbursement).

-

Asset Deposit: No charge.

-

Asset Appraisal: Fees payable directly to the approved appraiser.

-

Loan Application: No application fee.

-

Performance Bond Insurance: Typically 0.05% to 2% of the insured value (recommended providers include Lloyd’s of London).

Yes. You may fund your account with USDT or BTC. Prominence Bank will convert your deposited cryptocurrency into your account’s currency (e.g., USD, EUR). We do not offer crypto trading services—we only process deposits and fiat conversion.

Yes. We accept deposits in multiple currencies; standard exchange/conversion fees apply (see the Fee Schedule). Using your account’s designated currency minimizes conversion costs.

Absolutely. Prominence Bank provides a comprehensive and versatile banking platform, enabling you to receive funds seamlessly via KTT Telex—a secure and efficient method for transferring large sums.

Once credited to your account, you have the flexibility to make payments to banks worldwide through wire transfers using IBAN or SWIFT. This global payment capability ensures you can manage and distribute your funds with ease and efficiency, whether for personal or business purposes.

Yes, after depositing cryptocurrency into your account, you can withdraw funds in USD or Euro, depending on your account’s currency settings.

While Prominence Bank primarily focuses on corporate and institutional clients, personal banking services may be available depending on your financial needs. Please contact us for more details.

Yes. Prominence Bank accepts all KTT transactions regardless of the format or verbiage, provided they are transmitted through standard international banking channels.

Each remitter follows its own compliance and messaging format, and we credit the KTT transaction exactly as it is received, subject to completion of our compliance and verification procedures.

Yes. We accept USDT (TRC-20) and BTC deposits and convert them into your account’s fiat currency after compliance checks. We do not offer trading services. Fees for conversion/network may apply (see Fee Schedule).

Prominence Bank can receive and credit the KTT transaction from a duly authorized financial institution even if it has no clearing number or correspondent bank, provided the transmission is authenticated and compliant.

Requirements (non-negotiable):

- Authorized remitter: Sender must be a recognized financial institution able to issue authenticated KTT/Telex messages.

- Secure channel: Messages must be transmitted over verifiable interbank rails (KTT/Telex or SWIFT) with proper authentication/traceability.

- Compliance checks: Full AML/CFT, sanctions, and risk screening apply. Unverifiable or non-compliant messages are held or rejected.

- Format policy: We accept all standard KTT verbiage. We do not pre-approve templates or review formats by email.

- Bank-to-bank only: We do not communicate with other financial institutions via email. All interbank requests must be sent via KTT/Telex or SWIFT.

Fees & Balance Rules (KTT):

- 1.5% banking fee applies to received KTT transactions; deducted from the account available balance upon completion.

- Minimum available balance: $/€5,000 (personal) or $/€10,000 (business), excluding fees.

- Once banking coordinates are shared, the account holder is 100% liable for KTT transaction fees.

- SWIFT transfers are recommended when fee-coverage certainty is a concern.

- MT799/MT999 are not required to receive a KTT. If a client requests outbound messaging to the remitter, a €25,000 fee per message applies.

Processing & Posting:

- We credit the KTT transaction strictly according to the remitter’s authenticated instructions after successful authentication and compliance review.

- Timing depends on the remitter’s message quality and any required regulatory reviews; no guarantees are provided on posting time.

Scope & Limitations:

- For security and regulatory reasons, we do not pre-approve or validate third-party formats in advance. The transaction will be accepted and processed as long as it meets international compliance and authenticity standards.

- We do not disclose account transfer coordinates or internal processing details to third parties outside secure interbank channels.

Responsible Team:

Telex & KTT Operations Division — telex@prominencebank.com

Yes. Upon request, Prominence Bank can issue a Readiness, Willingness & Ability (RWA) confirmation for existing clients whose accounts are active and in good standing, subject to full verification and internal due diligence. RWA confirmations are delivered via SWIFT or KTT, and—when applicable—may also be displayed through our Document Verification Portal on our website for third-party validation. Fees apply; please refer to our Fees Table in the website’s Fees section for current charges related to RWA, bank comfort letters, or similar confirmations.

Please note: an RWA is not required by Prominence Bank to receive an incoming KTT. We will credit the KTT transaction exactly as received from the remitting bank once our compliance checks are complete.

If your counterparty requires an Irrevocable Payment Guarantee (IPG) or other binding bank instrument (e.g., SBLC/BG/LC/MT760), this is available only under a separate application, with collateral and instrument-specific fees, and remains subject to full due diligence and approval.

Clients must maintain the required minimum available balance and coverage for the 1.5% KTT fee.

After your KTT transaction is credited and verified, the balance becomes part of your regular account holdings. You can send outgoing transfers through SWIFT directly from your Internet Banking portal, following standard compliance and authorization steps.

Prominence Bank does not convert or modify the KTT transaction itself — the credited value remains as received from your remitting institution.

For assistance or transaction support, contact the Accounts & Compliance Department at account@prominencebank.com.

Please note that Prominence Bank does not accept SKRs issued by external storage facilities. To proceed with any transaction, the assets must be deposited with Prominence Bank. Upon deposit, an SKR will be issued directly by our bank, ensuring full bank responsibility and validity for monetization purposes.

Prominence Bank – Bank Endorsement Guarantee

A bank endorsement is a form of guarantee provided by a bank, commonly used for negotiable instruments such as banker’s acceptances or time drafts. It assures all parties in a transaction that the bank stands behind its customer, fostering trust, credibility, and transactional security.

How It Works:

-

Bank as Intermediary: Prominence Bank vouches for the trustworthiness and creditworthiness of its customer, making transactions smoother and more secure.

-

International Trade Support: Widely used in cross-border commerce, bank endorsements help establish trust between parties who may not have prior dealings.

Our Offering:

Prominence Bank provides a formal bank endorsement guarantee, confirming that we will uphold and guarantee an agreement or commitment made by our customer to a third party. This assurance gives your partners the confidence that Prominence Bank will step in if obligations are not fulfilled.

Benefits of a Prominence Bank Endorsement:

-

Full Endorsement: Applicable to agreements, projects, and negotiable instruments.

-

Increased Trust: Strengthens your negotiating position and facilitates deal closure.

-

Enhanced Reputation: Our name and credibility reinforce your standing in the marketplace.

-

Global Reach: Supports both domestic and international transactions.

-

Comprehensive Coverage: Includes banker’s acceptances and time drafts.

-

Opportunity Creation: Opens doors to new business relationships and ventures.

The custody account carries a non-refundable fee of EUR 25,000. This is a service fee (“cost to the account”), not a minimum balance and not available for your use. The custody account is designated to hold assets, not liquid funds, and therefore does not have any minimum balance requirement. Any minimum balance obligations apply only to your normal operational/current account, not to the custody account.

Prominence Bank offers a broad range of services, including personal and corporate banking, KTT account transfers, SBLCs and Bank Guarantees, escrow services, cryptocurrency accounts, structured finance, corporate finance, private banking, trade finance, and investment banking solutions.

Card Force Payment (7)

Yes. Activity is monitored for fraud and compliance, and may be restricted at the bank’s discretion.

Yes. Disputes and reversals may be possible under card network rules and subject to evidence review.

You must be an account holder and request activation through official bank channels; approval depends on eligibility and jurisdiction.

No. It is offered only where legally permitted and subject to policy and compliance review.

It refers to direct debit to a card, used for recurring/forced payments where legally permitted.

The bank may require a mandate/authorization, purpose, and supporting documentation depending on transaction profile and corridor.

Eligible Prominence Bank account holders and approved commercial arrangements (where applicable), subject to risk and documentation.

Cheque Payment (7)

Yes. For risk and fraud prevention, the bank may place a hold until the cheque is verified and cleared.

Where supported, international cheques may be accepted but often require longer collection times and additional verification.

Clearing times vary by jurisdiction, amount, and bank, and may take several business days, especially for third-party or international cheques.

Common reasons include insufficient funds, signature mismatch, stop-payment instructions, or an invalid/stale cheque date.

A cheque is a paper payment instruction signed by an account holder that authorizes the bank to pay a specified amount to a named payee after clearing.

Use a clear payment reference (invoice number, contract reference, or beneficiary identifier) to support reconciliation.

Cheque services are available to eligible Prominence Bank account holders, subject to account standing and internal policy.

Credit Card Direct (7)

Yes. Credit card transactions may be subject to chargeback/dispute processes according to card network rules.

Limits may apply based on client profile, risk assessment, and corridor capability.

Information is public, but usage is restricted to Prominence Bank account holders only.

No. Stripe and PayPal are third-party rails; Credit Card Direct refers to direct card processing where supported

Transactions are subject to monitoring, fraud controls, and AML-related review where required, in line with account risk profile.

It refers to direct payment by credit card without intermediary gateways, where supported.

Available to eligible Prominence Bank account holders and depends on corridor support and compliance review.

Cryptocurrency Accounts & Services (14)

Depending on the underlying rail, transfers may be irreversible once executed/confirmed; clients must verify recipient details carefully.

Prominence Bank’s crypto accounts are meant for facilitating legitimate investment and transfer purposes. There are a few points to note: (1) We currently support the major cryptocurrencies (e.g., BTC, ETH, USDT); other altcoins may not be available unless converted into one of the supported coins first. (2) KTT transfers cannot be used to pay crypto account fees – meaning, for example, you couldn’t fund the initial €25k via a crypto transfer without conversion; it has to be SWIFT or USDT as specified . (3) We require that crypto coming in or out goes through our compliance checks – so if you’re withdrawing a large sum in crypto, we might ask for clarification to ensure it’s going to a wallet you control (to prevent errors or fraud). (4) There are daily limits in place for very large crypto transfers for security (internally, we might break transfers into tranches). But generally, unless you’re attempting something extraordinary, you’ll find our crypto accounts quite flexible. We do not impose small rigid caps – we have clients moving seven-figure amounts in crypto seamlessly. As always, all transactions must comply with any relevant regulations (for example, we wouldn’t allow transfers to sanctioned addresses or proceeds from illicit activities, just as with fiat).

Yes. Limits may apply based on client profile, jurisdiction, and transaction risk appetite.

No. Prominence Bank applies a compliance-led framework and may decline or restrict activity at its sole discretion.

Prominence Bank supports crypto → fiat conversions only. If you deposit supported cryptocurrencies (e.g., BTC, ETH, USDT), you may instruct us to convert a chosen amount to EUR/USD and credit your regular account balance. We do not sell cryptocurrency and do not execute fiat → crypto purchases. Conversions are processed at prevailing market rates and may include a commission or spread; network fees may apply to crypto movements. All requests remain subject to compliance review and standard security checks.

Availability depends on jurisdiction, risk review, and internal policy. Access is granted to eligible Prominence Bank account holders only.

Our crypto account is primarily for storage, transfers, and conversion of established cryptocurrencies. We are not an investment advisor or broker for crypto projects or ICOs. However, by having a crypto account with us, you have the liquidity and ability to deploy funds into crypto quickly. For instance, you could convert some of your holdings to crypto and then send BTC or USDT to participate in an external investment (assuming you handle that part). We do due diligence on large outgoing crypto transfers just to ensure they aren’t scams – for your protection – but we don’t stop clients from making legitimate investments. We don’t offer ICO underwriting or token custody beyond the major coins. If you are interested in emerging crypto investments, our role would be to provide a secure base to move funds in and out of those investments. Also, our team stays updated on digital asset trends, so while we don’t give specific investment advice, we can share general insights or connect you with trusted partners (for example, an exchange or fund we have vetted). In sum, we’re a gateway and safehold for crypto, not a trading platform or investment manager for speculative tokens.

The bank holds the private keys on your behalf, as part of our custodial service. This is by design – it relieves you of the burden of key management and leverages our security framework. It’s similar to how we hold fiat: you don’t personally shuffle cash in a vault; we maintain it electronically for you. Likewise, with crypto, we keep the keys in secure custody. When you want to send crypto out or receive crypto in, those transactions are executed through our systems at your instruction. Some very technically-inclined clients ask if we support external wallet connectivity – at this time, we do not provide something like a MetaMask integration; all movements go through our secure portal. The upside is you benefit from insured custody and risk mitigation. If, for any reason, there were a security breach on the bank’s side (which we have never had), the bank is responsible for the loss, not you – unlike personal crypto wallets where if you lose a key, it’s gone forever. So, entrusting the private keys to us is part of the service that we offer to safeguard your digital assets.

Yes, Prominence Bank recognizes the importance of digital assets and offers Cryptocurrency Accounts to clients . A cryptocurrency account allows you to securely store and manage your crypto holdings through our bank. You can fund your crypto wallet with popular cryptocurrencies and seamlessly transfer value between your crypto account and your regular bank account . In essence, this bridges the crypto world and traditional banking: you could deposit Bitcoin or USDT with us, and then convert it to EUR or USD in your bank account (or vice versa). All crypto transactions are handled with bank-grade security and utmost confidentiality, leveraging our tax-haven jurisdiction for privacy benefits . We currently focus on major cryptocurrencies – for example, Bitcoin, Ethereum, and USDT (Tether) are supported for account funding and fee payments (the €25k opening fee can even be paid in USDT) . Our crypto accounts are custody accounts, meaning the bank safeguards the private keys and coins for you, so you don’t have to worry about managing hardware wallets – you access your balance through our online portal just like any other account.

Opening a crypto account with Prominence Bank is similar to opening any other account. You’ll need to go through our application process (providing KYC documents – passport, etc., the same as for a fiat account). The one-time account opening fee is €25,000, just like our standard account fee . Once open, the minimum balancerequirement for a crypto account is very low – only about $100 (in crypto) needs to remain in the account . There aren’t monthly fees specific to crypto accounts beyond what normal accounts have. After activation, we’ll provide you with wallet addresses or instructions to deposit cryptocurrency. One important note: you cannot use incoming crypto to waive the opening fee – the fee must be paid upfront (via SWIFT or USDT) to activate the account . But after that, you can freely move crypto in and out. Essentially, the cost is the same entry fee as our other services, and then it operates as a secure crypto custody service under our bank.

Extremely secure. Prominence Bank uses institutional-grade crypto custody solutions to protect your digital assets. Private keys are stored in secure hardware modules (with multi-signature authorization, meaning no single person can move funds). We treat crypto deposits with the same level of security as large fiat deposits – including layered authentication for access, continuous monitoring, and insurance coverage where applicable. Moreover, because your crypto account is within a bank, it benefits from the same privacy and confidentiality as any other account . There’s also a convenience factor: since no personal wallet management is needed, you avoid risks like losing a seed phrase. In summary, storing crypto with Prominence Bank is as safe as it gets – you have the upside of crypto, and the peace of mind of a private bank’s vault around it.

Transactions are subject to KYC/AML, sanctions screening, source of funds/wealth validation, and ongoing monitoring.

It refers to decentralized or entity-issued digital currencies, subject to bank policy and jurisdiction.

Yes. For higher-risk or higher-value transfers, the bank may request documentation supporting source of funds/wealth and transaction purpose.

Digital Currency (7)

Depending on the underlying rail, transfers may be irreversible once executed/confirmed; clients must verify recipient details carefully.

Yes. Limits may apply based on client profile, jurisdiction, and transaction risk appetite.

No. Prominence Bank applies a compliance-led framework and may decline or restrict activity at its sole discretion.

Availability depends on jurisdiction, risk review, and internal policy. Access is granted to eligible Prominence Bank account holders only.

Transactions are subject to KYC/AML, sanctions screening, source of funds/wealth validation, and ongoing monitoring.

It refers to decentralized or entity-issued digital currencies, subject to bank policy and jurisdiction.

Yes. For higher-risk or higher-value transfers, the bank may request documentation supporting source of funds/wealth and transaction purpose.

Direct Bank Transfer (SWIFT) (7)